During election season, polls are often the source of news stories. However, data is often complex, confusing and even contradictory. That’s why pollsters and pundits analyze a variety of sources to paint a more complete picture of what’s to come.

This same philosophy and approach should be taken when studying construction data. Construction and economic data are useful tools, but it’s important to understand the information at hand before making decisions on a project.

The general contractor’s preconstruction team should analyze various sources to understand the environment in which the building is being constructed, including current economic climate, the region’s labor market, as well as the client’s industry and business market. This, along with asking questions and listening to the client, will give the team an understanding of the owner’s goals for the project and provide a “full picture” of the situation at hand.

“In the planning phases, gather as much knowledge as you can that’s specific to your project,” says James Tyson, Senior Vice President of Preconstruction at EMJ. “Don’t rely on one source—but many— before drawing conclusions.”

General contractors might assume that the potential client has done their research and that their project goals are strategic, measurable and viable. However, this is not always the case, and the preconstruction team can share data to inform them of potential conflicts they might face in building or operating their facility, such as labor shortages, a rise in material prices, regional economic outlook and more.

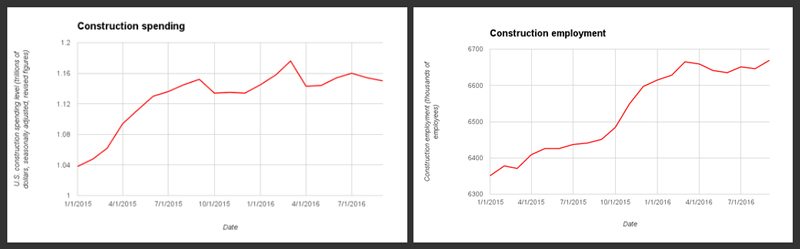

Bureau of Labor Statistics & ConstructionDive.com

How to use data to serve the client

The first rule in reviewing any statistical findings is to consider your source and its purpose. In general, construction data is less biased than political data or other studies, because it is based on business exchanges. But construction data can be misleading is when it is viewed too broadly.

“You can’t look at the construction spending findings for the entire country and think that it speaks for a rural market in north Georgia,” says Chris Grannan, Vice President of Preconstruction at EMJ.

Chris explains that national findings can be skewed by large markets such as New York, Los Angeles, Chicago and Dallas where construction projects are far more numerous and often of larger scale than other areas of the country.

“Use national numbers by breaking them down to the major market nearest your project,” Chris says. For example, when studying an industrial project in north Georgia, data from Atlanta and Nashville would provide the most insight, and Dallas and Houston numbers would aid a project in Beaumont.

Next, know what numbers matter. New construction reports arise daily— from the U.S. Commerce Department’s monthly spending stats to the Bureau of Labor Statistics’ employment data. The American Institute of Architects (AIA) offers the quarterly Architectural Billings Index, and Dodge Data and Analytics provides the momentum index gauging the number of projects out for bid.

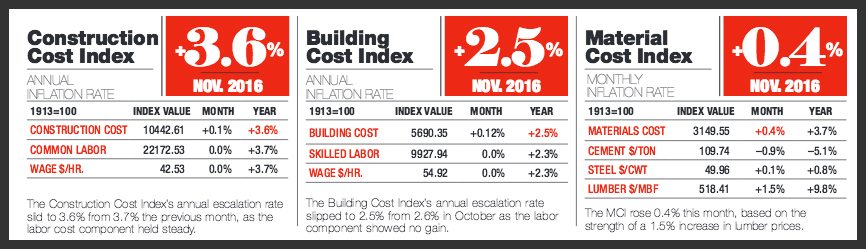

“The ENR [Engineering News-Record] data is what I find most useful,” James says. “It offers several cost indexes that could majorly impact a job. For example, the construction cost index is up 3.6%; building cost is up 2.5% and material cost is only up 0.4%. Clearly, it’s labor that is driving costs at the moment. You now have a greater understanding of what challenges you might face on the project.”

www.enr.com/economics

James also notes that ENR digs into material costs and breaks them down by the individual element, such as concrete, asphalt, stone, etc., as well as by major market. This allows preconstruction teams and owners to examine the costs of materials specific to their project and their region.

“We can’t see into the future, but we can use this data as a baseline for what a project might cost to build a year from now,” says James.

In the end, knowing the environment in which you will be working and managing a new facility is arguably as important as knowing your expectations for the finished product. An awareness of the current status of the industry is beneficial to both owners and general contracting teams.